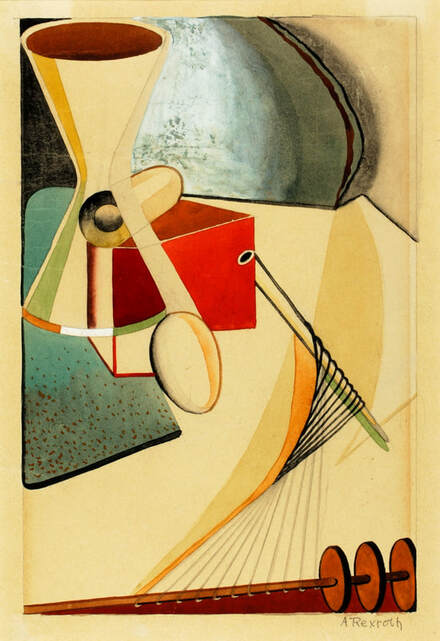

By Zdravka Todorova Post # 3  "Composition" pencil and watercolor on paper, Andree Rexroth (born Chicago, IL 1902-died San Francisco, CA 1940) Smithsonian American Art Museum, Transfer from General Services Administration. Record ID: saam_1971.447.76. New Deal\Works Progress Administration, Federal Art Project\California "Composition" pencil and watercolor on paper, Andree Rexroth (born Chicago, IL 1902-died San Francisco, CA 1940) Smithsonian American Art Museum, Transfer from General Services Administration. Record ID: saam_1971.447.76. New Deal\Works Progress Administration, Federal Art Project\California Inflation is not just a matter of disequilibrium in supply and demand and too much money in the economy. There are structural processes that drive the price level changes over time. The effects of inflationary pressures are exacerbated by the restrictive and unequal provision of necessities, which explains affordability crises. 1. Structural Processes of Inflation

Technological change, distribution, and environmental factors structure the economy and build inflationary tendencies simultaneously through supply and demand. It is more helpful to think about structural processes rather than supply and demand factors of inflation. 1.1. Technology of Production and Consumption Accelerating technological change deserves more attention as a potential driver of inflationary pressures in the future. There are false hopes that new technology would be a controlling factor for inflationary pressures. Technological improvements increase labor productivity and functional operation and reduce costs for businesses. This does not mean lower price levels. Presently there are wide efforts and significant resources directed towards investment in capacity expansion of the production of semiconductors, batteries, and related products. These are costly and long-term projects undertaken within multiple economies. Expensive capital-intensive investment in capacity expansion for high-tech production needs to be validated - expected to be paid for and to generate profits in the long run. This will come out in the form of price level increases. Government expenditures are only a validating fraction of the planned capacity expenditure and flowing private investment into semiconductors, batteries, energy, and mining. Investment costs are validated also by building expectations for expanded and restructured future demand for end products across all spheres of society and geographies. Technological advancement and capacity building develop together with plans for transformation in the consumption process. Consumption, production, and social services are being strategically restructured so that planned capacity-building expenditures and finance are underwritten by assurances of wide and reasonably stable future demand. Restructuring of demand does not only pertain to a greater level and scope but also to the method or technology of consumption. What would go in the consumption basket and how would people consume and engage in mobility, education, recreation, and all social activities? Even if the prices of some devices go down, other more expensive products enter non-discretionary consumption. Other goods like cars and housing would continue to be more expensive. In the changing technology of consumption, there will be moving away from ownership of durable goods (if you will, the means of consumption) towards renting and subscription to services. This allows continuity in locking in revenue streams, pricing power, and new markets, and helps companies through business cycle fluctuations. 1.2. Distribution Higher computational requirements would lead to the consolidation of products into centralized data centers that enable remote access, upgrades, and continuity of consumer use. This would expand the supply of incremental services and consumer financial commitments. Supplementing high-tech devices and durable goods with service offerings based on subscription delivery and upgrades is an example of creating a revenue stream. This business model would likely create a greater susceptibility to pricing strategies that rely on increasing mark-ups, as well as on covering costs including capacity expansion. Business concentration and market power would be a factor, but so would the change in consumption baskets of highly capital-intensive non-discretionary goods and services and dependencies in daily activities. In other words, I am arguing that occasions of “sellers’ inflation” that were described by Weber and Wasner (2023), as observed during the pandemic, could be exacerbated by this change in the technology of consumption. This is because workers’ living costs would be increasingly tied to consuming and using high-tech goods and services. Of importance here is that this happens under restrictive conditions of access to basics such as healthcare, nutrition, care, housing, and opportunities for wealth-building. In the face of automation, two likely sources of dependency could finance or fund the data-generating household consumption – consumer borrowing and government transfers for basic incomes. Both will support the concentrating business and finance enterprise and wealth and will tie down people. In this scenario, displaced workers likely will be something like influencers for AI models. Controlling inflation then is not about cooling cyclical aggregate demand exceeding supply. It is about exercising democratic powers over market conditions and ownership, under which new streams of revenues in profit and rents are created. 1.3. Environment and Land Environmental disruptions have become structural factors of inflation for globalized production, as explained by Alla Semenova (2023). Increased heatwaves, droughts, floods, soil erosion, water shortages, and pollution are not occasional disaster events. They are expected to continue contributing to shortages, uncertainty, and higher costs, as evidenced in multiple key sectors. To connect this to technological change, building capacity in high-tech production has a lengthy timeline and is likely to be disrupted by environmental and geopolitical factors. This increases the expected costs of capacity expansion in semiconductor, battery, and other high-tech production. and reinforces greenfield investment in multiple regions. High-tech expansion depends on the significant growth of minerals extraction the expansion of the metals and mining sectors, and the extraction of critical minerals and metals, including lithium, nickel, and cobalt needed in battery production. Ecological and social disruptions inevitably follow land usage and fragmentation, waste processing, and absorption. Global reorganization of land use, work, and disruption of culture and habitats would accommodate the desire for capacity building of the new machine process. In that, absentee land ownership and new rent income streams are of increasing importance, not only in food and energy production but also for expanding high-tech production. 2. The Strings of Provision These pressures highlight the importance of the existing systems of provisioning for necessities. Food, housing, utilities, mobility, health, care, wealth building, and retirement are vital areas. How are those systems of provision affected by inflationary pressures, and to what extent does their current organization help or exacerbate affordability? 2.1. Food and Water Systems A more concentrated food system could experience strain because of environmental deterioration, wars, and rising costs of production, including energy, irrigation, fertilizers, and pesticides. In addition, there is more competition for water and land because of high-tech production and mining of lithium and other resources to expand battery production. Semiconductor production requires clean water and large spaces. Making space for industrial mega-sites potentially could help restrict farmland. Agriculture will become even more capital-intensive, with greater reliance on computation power and data. As this might enable more intensive production, it would also contribute to the trend of greater control and centralization of food systems and land. The strains of this centralization are in addition to the destruction of people, their reproduction, housing, and lands, and the degradation of ecosystems through war and authoritarianism. 2.2. Housing In the USA, housing wealth – the market value of a home minus outstanding loans secured by the home – grew between 2019 and 2022 (Alandagady et. al. 2023). However, transitioning from rent into homeownership is more difficult with the higher costs of homeownership, including higher mortgage rates. Investors have been buying houses – presently representing 18.5% of US sold homes, and 26 % of the lowest-cost single homes (Katz, 2024). Most of these investments tend to be in inexpensive single-family starter homes in growing US metro areas that could be rented out, as homeownership has become more unaffordable for new buyers. Meanwhile, 49% of renter-occupied units in 2021 spent 30 % or more for housing out of their budgets. Even small increases in expenditures and prices can contribute to household budget fragility or housing insecurity. No state has an adequate supply of rental housing affordable and available for extremely low-income households, who account for 25 % of renter households in the USA (National Low Income Housing Coalition, 2024). Pressures on land values in areas that expect growth due to new industrial development would likely exacerbate the problem of housing availability, affordability, and housing wealth-building. 2.3. Utilities Access to affordable quality housing is related to utility bills. Households who were energy insecure were billed $ 0.20 more per square foot than the national average. Energy insecurity is defined as receiving a disconnection notice, having reduced or forgone necessities to pay energy bills, keeping unsafe temperatures because of cost, or being unable to repair equipment because of cost (U.S. Energy Information Administration). Higher energy costs for lower-income households are a function of rents, the quality of housing, insulation, and the efficiency of appliances, and are exacerbated by inflation. Energy price increases find people in housing conditions that are difficult to alter, especially at low levels of income. Utility costs affect health, and have a long-term impact on credit scores, moving into home ownership, and thus wealth-building. 2.4. Mobility Similarly to housing, ownership will be less accessible, and more demand for the creation of rental markets. US Households in the lowest income quintiles spent 30.2 % on transportation out of their after-tax income compared to 11 % of the highest income quintile in 2022 (Bureau of Transportation Statistics, 2022). Car-dependent, commuting working households are affected not only by the price of fuel but also by the price of new and used cars and the increasing costs of their maintenance and insurance. This is not an issue that is going to be resolved through electric cars because of the price range. Ownership of cars has become more expensive. Some factors are new built-in technology, costly repairs, software subscriptions, and upgrades, amid shrinking inventories of used cars. Car ownership will continue to be costlier and the new business model of mobility will be restructured around rent and share. This demand will be created through investment and validating the capacity expansion discussed above. Eventually, this is to be facilitated by the implementation of connected and autonomous vehicles. This transition away from private car ownership could also continue to restrict people’s mobility if affordable quality public transportation systems are not developed. 2.5. Care Care is the core of the economy. Care is a social process that encompasses multiple paid and unpaid activities and interpersonal relations. For that reason, deprivations in care are multifaceted. For example, in addition to higher costs for paid care, unpaid care is impacted by the budgets and deprivations in necessities, as well as by available time. One problem is the availability and affordability of childcare centers, particularly for infant and toddler care. The costs of childcare have become untenable for many households, while at the same time childcare providers are some of the lowest-paid workers (Landivar, 2023). Unavailability in lower-income neighborhoods also means more difficulty in access because of distance, transportation, cost, and less predictable work schedules. There is a shortage of childcare centers and closures. Disruptions in the operation and availability of childcare centers have not recovered after the pandemic, but also this is the legacy of inequities and ignoring care as a macroeconomic policy issue. 2.6. Health All of the above systems of provision directly factor into health. One issue is that in the USA healthcare insurance is largely tied to employment and occupational status. With technological job displacement, part-time work, and more informal, this is going to be even a bigger problem. Deprivations and cost increases inhibit access to preventative healthcare. Prevention however, cannot be addressed only through access to electronic bio-monitoring – there needs to be access to actual treatments. Public health vulnerabilities also compound when ecosystems are disrupted and people’s immunity is weak because of living conditions. As observed, in itself, the pandemic contributed to inflationary pressures. Factors reducing healthcare costs and improving health include environmental justice, ecosystem restoration, equitable housing and utilities, nutrition and clean water, quality care, public mobility, and access to nature and recreation (see Robinson et al. 2022). All of those aspects of living conditions are impacted by racial and other injustices with long-lasting consequences (Townsley and Andres, 2021). 3. Beyond Strings of Provision While the rate of inflation has decreased, the undertaken processes of investment and planned restructuring of consumption would bring new inflationary pressures. Those would be difficult to characterize as either supply or demand factors. It is not sufficient to fix the supply chains. Also households and social services are fundamentally limited in their ability to control costs. It is a good idea to improve quality access to vital areas of economic life. Policy support for expanding care, housing, and nutrition is a positive move. There are too many deprivations that need to be addressed, and these would be worsening in the transition period of technological change. Also, it is not at all clear that those deprivations will be addressed or won’t worsen when production and consumption restructure under the new business models and technology. At the very least, each area of basic provision proactively needs public commitment to alternatives that are decentralized and democratic (rather than only technocratic and business-driven). Those additional alternatives need to be based on principles like food solidarity, participation, human rights, ecosystem restoration and justice, care, home- and job guarantee through public service, and common public spaces and mobility. Cite this Blog: Todorova, Zdravka. (April 6, 2024). “Structural Processes of Inflation and Restrictive Strings of Provision.” Econ Notes & Knots, Blog # 3, www.ztodorova.net References Aladangady, Aditya, Andrew C. Chang, and Jacob Krimmel et al. Oct. 18, 2023. “Greater Wealth, Greater Uncertainty: Changes in Racial Inequality in the Survey of Consumer Finances” Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/econres/notes/feds-notes/greater-wealth-greater-uncertainty-changes-in-racial-inequality-in-the-survey-of-consumer-finances-20231018.html Bureau of Transportation Statistics. 2022. “Household Spending on Transportation: Average Household Spending.” US Department of Transportation. https://data.bts.gov/stories/s/Transportation-Economic-Trends-Transportation-Spen/ida7-k95k/ Center for American Progress. 2020. Childcare Deserts. https://childcaredeserts.org/ Davidson, Kate and Dirk Vander Hart. April 4, 2023. “Meet the Farmers Who Want to Grow Semiconductors, and Their Neighbors Who Don’t.” Oregon Public Broadcasting. https://www.opb.org/article/2023/04/04/hillsboro-oregon-portland-development-urban-growth-boundary-ugb-farmers-land-use/ Katz, Lily. Feb 14, 2024. “Investors Bought 26% of the Country’s Most Affordable Homes in the Fourth Quarter—the Highest Share on Record.” Redfin. https://www.redfin.com/news/investor-home-purchases-q4-2023/ Landivar, Christin. Jan 24, 2023. “New Childcare Data Shows Prices Are Untenable for Families.” US Department of Labor. https://blog.dol.gov/2023/01/24/new-childcare-data-shows-prices-are-untenable-for-families National Low Income Housing Coalition. 2024. “The Gap: A Shortage of Affordable Homes.” https://nlihc.org/gap PBS Newshour. Jan 25, 2024. “How Demand for Lithium Batteries could Drain America’s Water Resources.” https://www.pbs.org/newshour/show/water-domestic-lithium-mining Robinson et al. 2022. “Ecosystem Restoration is Integral to Humanity’s Recovery from COVID-19.” The Lancet 6. https://www.thelancet.com/journals/lanplh/article/PIIS2542-5196(22)00171-1/fulltext Semenova, Alla. 2023. “Rising Temperatures and Rising Prices: The Inflationary Impacts of Climate Change and the Need for Degrowth-Based Solutions to the Ecological Crisis.” Globalizations, 12: 1–18. https://doi.org/10.1080/14747731.2023.2222482 Townsley, Jeramy and Unai Miguel Andres. June 24, 2021. “The Lasting Impacts of Segregation and Redlining” https://www.savi.org/lasting-impacts-of-segregation/. SAVI. U.S. Energy Information Administration. May 30, 2023. “U.S. Energy Insecure Households were Billed More for Energy than other Households.” https://www.eia.gov/todayinenergy/detail.php?id=56640 Weber, Isabella M., and Evan Wasner. 2023. “Sellers’ Inflation, Profits and Conflict: Why Can Large Firms Hike Prices in an Emergency?” Review of Keynesian Economics 11 (2): 183–213. https://doi.org/10.4337/roke.2023.02.05. Zhong, Raymond and Amy Chang Chien. April 8, 2021. “Drought in Taiwan Pits Chip Makers Against Farmers” The New York Times. https://www.nytimes.com/2021/04/08/technology/taiwan-drought-tsmc-semiconductors.html Comments are closed.

|

Zdravka Todorova

I research, teach, and write about systems, processes, and relations of economic lives. Archives

Categories

|

RSS Feed

RSS Feed